The 2022 Fowler Center Impact Investing Competition

The Fowler Center for Business as an Agent of World Benefit at Weatherhead School of Management at Case Western Reserve University would like to thank the students, judges and our keynote speaker, Rumu Sarkar, who helped make our 2022 Impact Investing Competition a big success.

The 2022 Impact Investing Competition was held in person Feb. 25, in the Peter B. Lewis Building on the Case Western Reserve campus. Five student teams presented before a panel of six judges, all representing a unique and diverse field of investing and social impact-oriented practitioners.

Student presenters included a variety of Weatherhead School graduate students. Students presented a wide range of unique ideas and solutions to manage a portfolio of investments as impact investors. The competition was organized by Fowler Center fellows: Ayushee Agarwal, Kyle Regan, Nikita Tayal, Tyler Holsopple and Yicong Wang. The six judges included:

- Lynn Carpenter, co-founder of EPOCH Pi

- William Vogelgesang, co-founder of EPOCH Pi

- Christal L. Contini, co-chair of Mergers & Acquisitions Practice Group, McDonald Hopkins, LLC

- Amy Wojnarwsky, business associate in the Business Department of McDonald Hopkins, LLC

- Ben Cooper, senior vice president, portfolio management, KeyBank

- Scott Hackenberg, social impact investor

Competition Format

The 2022 Impact Investing Competition was focussed on enhancing students' awareness of the United Nations Sustainable Development Goals (SDGs) and providing them with a real-world understanding of portfolio management in the impact-investing space. Students were given an opportunity to be creative in their roles as impact investors and create portfolios of investments that had maximum impact coupled with good financial returns.

Students were provided certain guidelines to follow a five-step procedure:

- Choose a UN SDG;

- Formulate an investment thesis;

- Determine investments and allocate funds;

- Perform due diligence; and

- Prepare and present an investment thesis. Teams were responsible to allocate $100 million in one to three investment opportunities.

For performing due diligence of their chosen investments, students were given a rubric to grade their investment on multiple attributes including management team, mission definition, potential to scale, financial returns, business model and risk strategy. After finalizing their portfolios and completing due diligence, teams were required to present their investment portfolio to a panel of potential investors (judges of the competition) through pre-recorded videos.

The pre-recorded, seven-minute-long video presentations from the participating teams addressed the reasons behind choosing specific UN SDGs, their investment theses, their approaches for determining investments and overview of each investment. Teams also highlighted how these investments measured up during due diligence and how they would track the success of their investments over a period of time.

Each team was given a specific time slot during which the pre-recorded video presentation was played. After the video concluded, judges had a five-minute live Q&A session with each team to understand their investment choices and strategies. Judges evaluated each team and also provided their valuable feedback, which was shared anonymously with participating teams after the competition was concluded.

The pre-recorded interview between Fowler Center fellow Ayushee Agarwal and keynote speaker Rumu Sarkar was streamed post the presentation of all the teams, followed by a live Q&A session.

Success of the Competition

We are happy and proud to have received positive feedback from students as well as the judges.

The majority of the students felt that the competition was a good way to learn about impact investing and social value creation. Students appreciated the creative and flexible approach of the competition. Students were able to learn more about the UN SDGs and how impact can be created to achieve these goals. Students enjoyed the flexibility to work with and compete against Weatherhead School students from diverse degree programs. Judges enjoyed seeing the creativity and the thought processes of the students.

We also extend our sincere gratitude to Sarkar, general counsel of Millennium Partners and adjunct professor at Case Western Reserve University School of Law. She was the keynote speaker (through a pre-recorded interview) for this competition and has been phenomenal in lending her support and advice throughout this competition.

Winning Teams

From the participating teams, judges selected first-place and second-place teams.

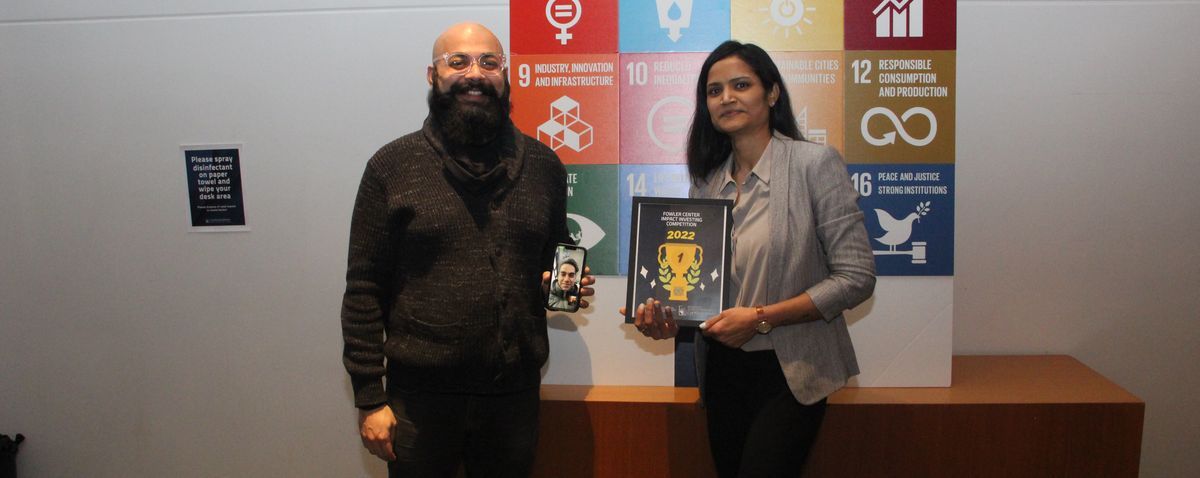

First place with a cash prize of $2,000 was won by the full-time MBA team "Coffee & Finance" with members Anshul Gupta (full-time MBA), Samit Kumar Chauhan (full-time MBA) and Suyash Pranjal (full-time MBA).

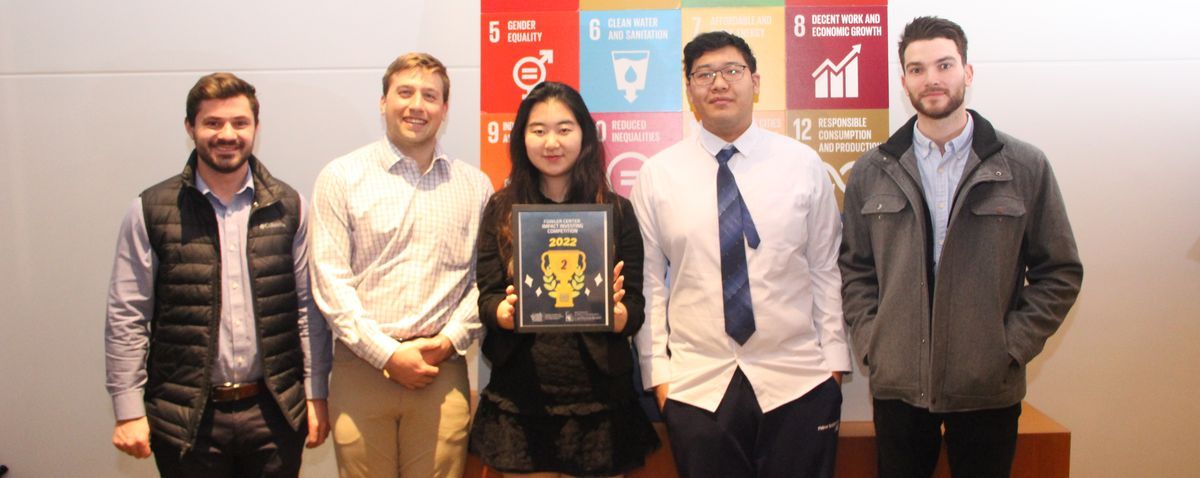

Second place, and a prize of $1,000 total, went to team "ESG Capital": Colin Basinski (full-time MBA), Brandon Gathagan (full-time MBA), Nick Cwikla (full-time MBA), Shawn Sun (MSM- finance), and Yuzi Li (MSM-finance).

Many congratulations to our first place and second place teams!

All the participating student teams worked hard and served as great representatives of the Weatherhead School student body. We hope students enjoyed themselves and learned from the experience. We are looking forward to seeing you in-person next year!

Competition Speakers and Judges

Keynote Speaker

Rumu Sarkar

Rumu Sarkar, PhD, was pleased to join the adjunct law faculty of Case Western Reserve University to teach international development law in the spring semester of 2022.

Sarkar is the general counsel of Millennium Partners (MP), an international development consulting group based in Charlottesville, Virginia. MP focuses on implementing and evaluating Rule of Law reform projects in Eastern Europe and Africa. Sarkar was also the former general counsel for the 2005 Defense Base Closure and Realignment (BRAC) Commission. She also served as the general counsel for the Overseas Basing Commission, prior to joining the BRAC Commission.

Sarkar was the former assistant general counsel for administrative affairs for the Overseas Private Investment Corporation (OPIC) (now the U.S. International Development Finance Corporation, "DFC"), and formerly a staff attorney with the Office of the General Counsel of the U.S. Agency for International Development (USAID). She began her career as a litigation associate with two Wall Street law firms in New York.

Sarkar has had a distinguished academic career both in teaching and publishing. She is an assistant professor at the Uniformed Services University of the Health Sciences, School of Medicine. This is the Pentagon's medical school for its active duty medical students and global health specialists, co-located with the Walter Reed National Military Medical Center in Bethesda, Maryland.

She won a Fulbright Scholarship and lectured at the John Paul II School of Law in Lublin, Poland in 2016. Sarkar was also a distinguished guest lecturer and served on the advisory board for Loyola University Chicago School of Law. She was also an adjunct law professor and a visiting researcher at the Georgetown University Law Center for many years where she taught several graduate law seminars. Sarkar has authored six legal texts and many law review articles.

Sarkar completed her undergraduate studies (BA) at Barnard College, Columbia University; her law degree (JD) from the Antioch School of Law; and her Masters of Law (LLM) degree, and her PhD in philosophy from Newnham College, Cambridge University. She is a member of the NY, DC and U.S. Supreme Court Bars. She is also admitted as "In-House Counsel" in the Massachusetts Bar.

Judges

Lynn Carpenter

Co-founder of EPOCH Pi, Lynn Carpenter has previously served as director for both South Franklin Street Partners and Candlewood Partners LLC. She also worked as an associate on the buyout team for Morgenthaler where she assisted in the management of $1 billion in capital. Carpenter has experience using culture assessment tools and is certified in using Denison Consulting's Organizational Culture Survey and has substantial experience adding both cultural and strategic alignment to traditional investment banking.

Christal L. Contini

Christal Contini is a member and a co-chair of the McDonald Hopkins Mergers and Acquisitions Practice Group. She also provides general corporate counseling to a variety of middle-market businesses, business owners, boards of directors, management teams and investors on matters relating to corporate governance, commercial contracts, compliance and operational issues. Her industry experience covers a wide array of industries such as healthcare, restaurants and manufacturing.

Ben Cooper

Ben Cooper is senior vice president of utilities, power, and renewable energy, where he helps KeyBank invest in renewable energy, with a focus on solar and wind electricity generation, as well as utility-scale batteries. Cooper joined KeyBank after completing his MBA at Weatherhead School of Management in 2015, where he was also an inaugural Fowler Center fellow. Before moving to Cleveland, Cooper earned his BA in economics from the University of Chicago. In his eight years in Fitch's Global Infrastructure and Project Finance Group, he concentrated on conducting credit analysis on power projects. In his spare time, Cooper enjoys strength training and remembering when he played ultimate frisbee.

Scott Hackenberg

Scott Hackenberg is the founder of JSH Impact Advisors, where he develops purpose-driven investment strategies for fund managers in the private capital markets. Hackenberg worked in private equity for Blackstone, was the co-founder of Swander Pace Capital and a director with Triplepoint Capital, a venture debt firm on Sand Hill Road in Silicon Valley. Hackenberg pivoted to impact investing soon after that term came into existence and was brought in to help one of the early pioneers (RSF Social Finance) professionalize its $150 million social enterprise loan program. Hackenberg also worked with The Non Profit Finance Fund where he sourced and underwrote funding for community development projects in Oakland and California’s rural Central Valley. Hackenberg graduated with distinction from Cornell University and relocated back to Cleveland several years ago after 25-plus years in Silicon Valley.

Christopher Jeannot

Chris Jeannot is a relationship management officer specializing in portfolio management in Glenmede's Cleveland office. Jeannot works with senior investment professionals to provide tailored tax-efficient advice for private wealth clients. Before working at Glenmede, he was an investment advisor at PNC Bank, where he worked with clients to provide comprehensive investment advice and portfolio management. He also gained experience at Vigilant Capital Management, where he served as chair of the Proxy Voting Committee and member of the Investment Policy Committee. Jeannot received his BS from The University of New Hampshire and is also a CFA charterholder.

William Vogelgesang

Co-founder of EPOCH Pi, William Vogelgesang was previously a co-founder and CEO of Candlewood Partners LLC and South Franklin Street Partners. Vogelgesang has also served on the board of numerous Cleveland-based companies. He has also served as chair of the Management Committee of Brown Gibbons Lang and a lender for Citicorp and KeyBank. Vogelgesang is also certified in using Barrett Values Center's cultural transformation tools, to help EPOCH Pi clients align their values in merger and acquisition transactions.

Amy Wojnarwsky

Amy Wojnarwsky is an associate in the McDonald Hopkins' Business Department. She has provided counsel to privately held businesses in merger and acquisitions, contract and lending matters, new entity formation and business succession planning. Wojnarwsky earned her JD, cum laude, from Case Western Reserve University School of Law in 2013. She also received a master of elementary education, summa cum laude, from Arizona State University in 2009 and a BA in political science from Yale University in 2007.